Saving for downpayment in as little as 1.55 years

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. But what about if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. And Texas came in at 1.55 years! Check it out:

How did we get this? By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own. According to the data, residents in Texas can save for a 3% down payment in 1.55 years.

But what if I cannot qualify for a 3% program?

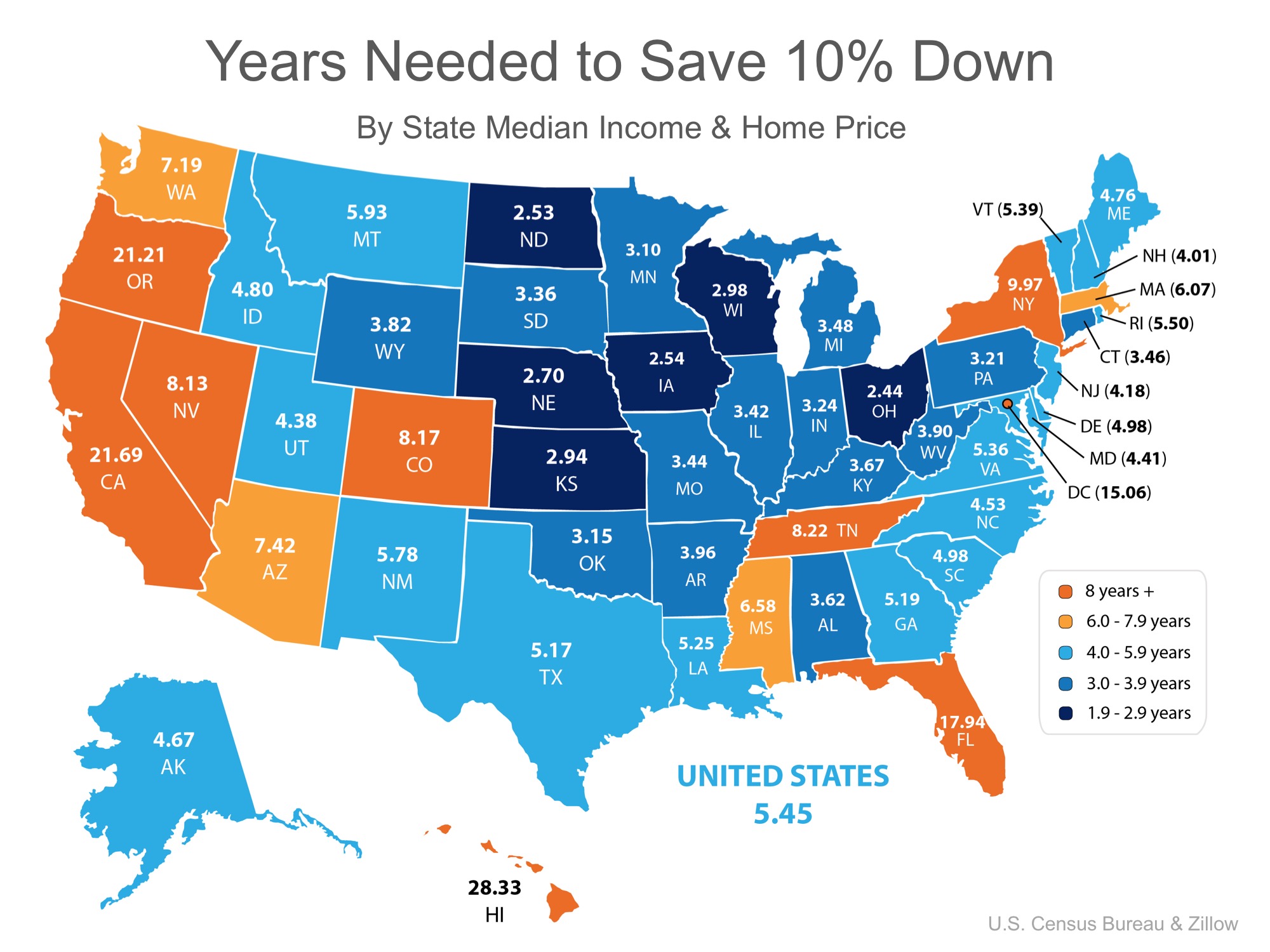

Is not the end of the world, it would just take a little longer. Here's the same map, but considering a 10% downpayment instead of a 3% downpayment. Texas comes up to 5.17 years:

Want to know more about 3% down payment programs?

Contact us, and we will put you in touch with our in-house mortgage broker.